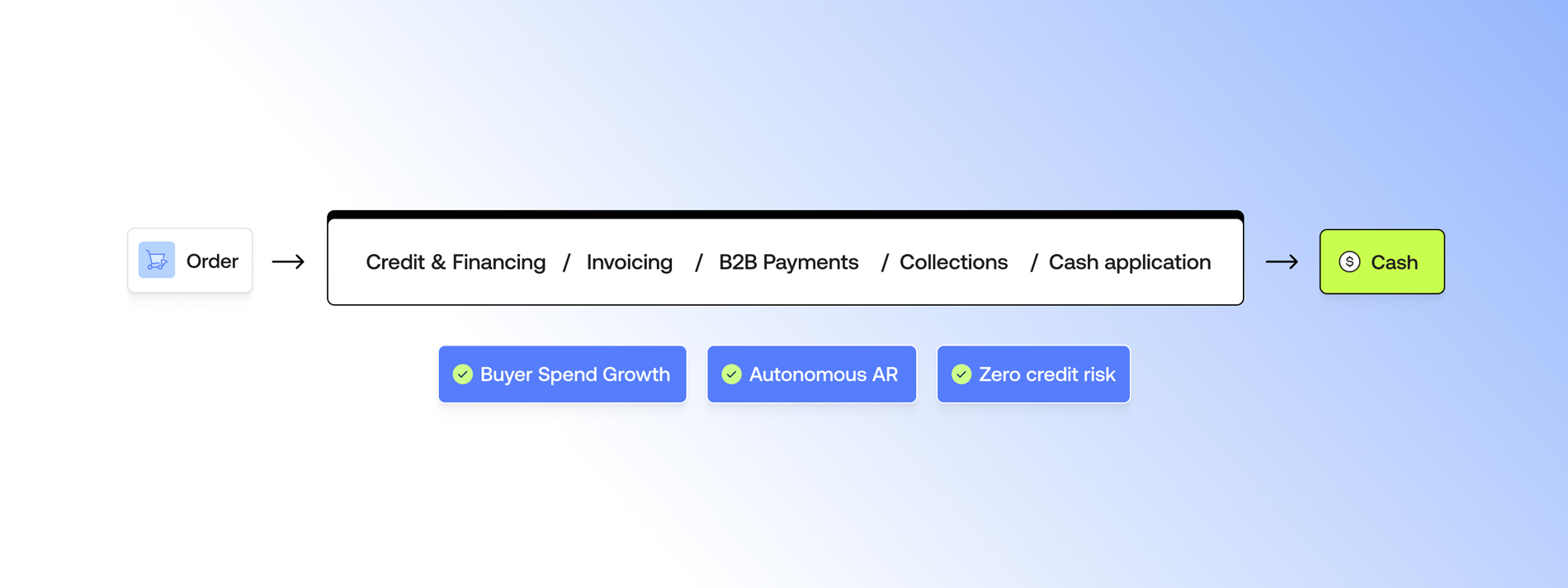

Financial Infrastructure for B2B Commerce

b2b commerce moves faster on balance

Trusted by the world’s leading companies

Grow B2B SALES with

net terms that scale

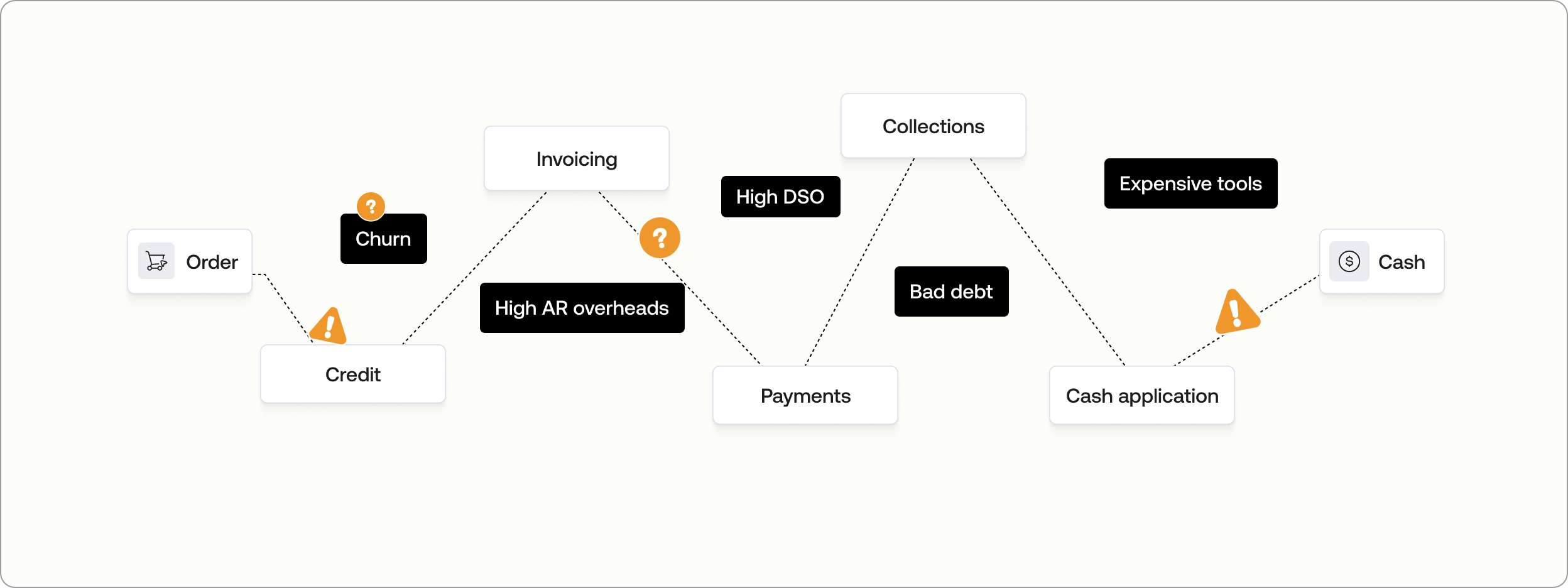

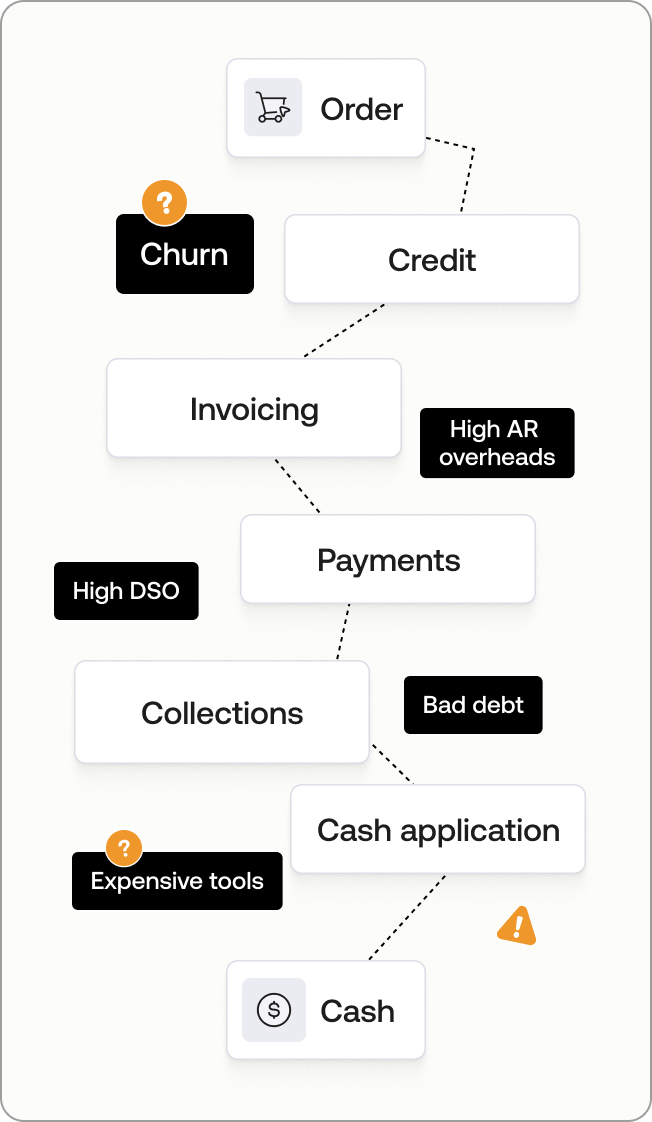

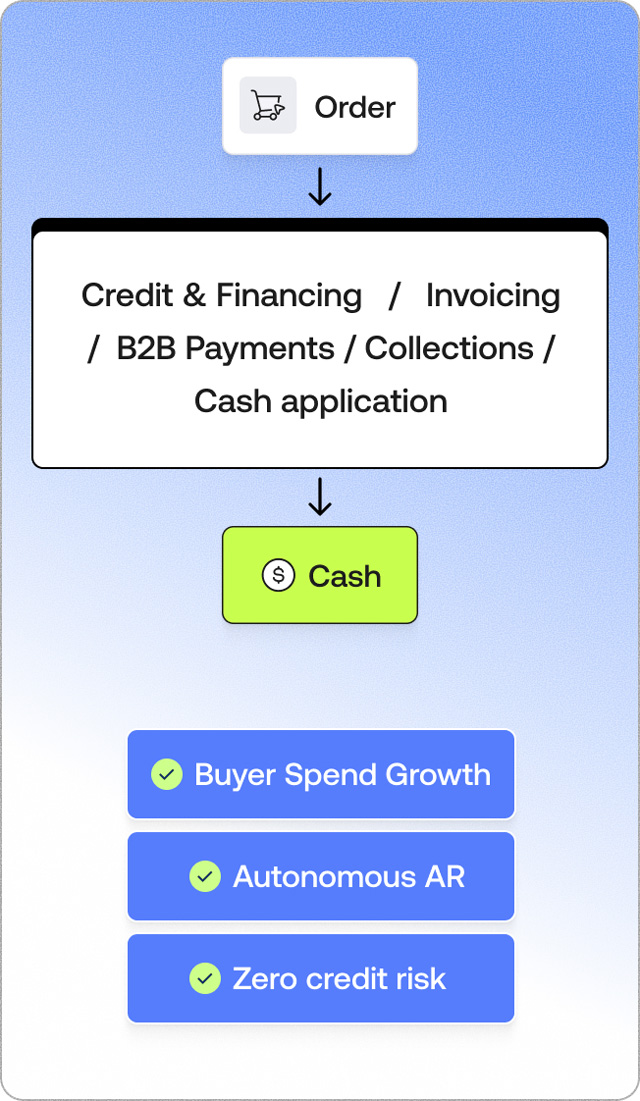

Stop stitching tools together. Automate complex B2B workflows for a self-serve payment experience – with zero AR overhead.

Give your B2B buyers what they need

Hear what happens when you do.

“As a small business, cash flow is always tight. With this option, I was able to invest in new inventory without hesitation – and the approval process was quick and painless.”

Owner

Independent Retailer

“Net terms payment has allowed us to pay for the inventory after we have had a chance to sell it. We’re increasing revenue without the stress of interrupting cash flow.”

CFO

Electronics Reseller

“Budget-wise, it was not time for me to purchase new inventory, but with net terms I have been able to grow my inventory! I was easily approved, and then repayment was easy!”

Co-owner

Fashion Boutique

“Pay-By-Invoice has drastically streamlined the expense process for our accounts payable team without the stress of tracking down receipts.”

COO

Healthcare Network

“This new invoicing option has helped us streamline procurement and eliminate the hassle of juggling multiple credit card payments each month.”

Purchasing Leader

National Restaurant Chain

All you need to offer

terms at scale

invoicing at scale, minus the credit risk & overhead

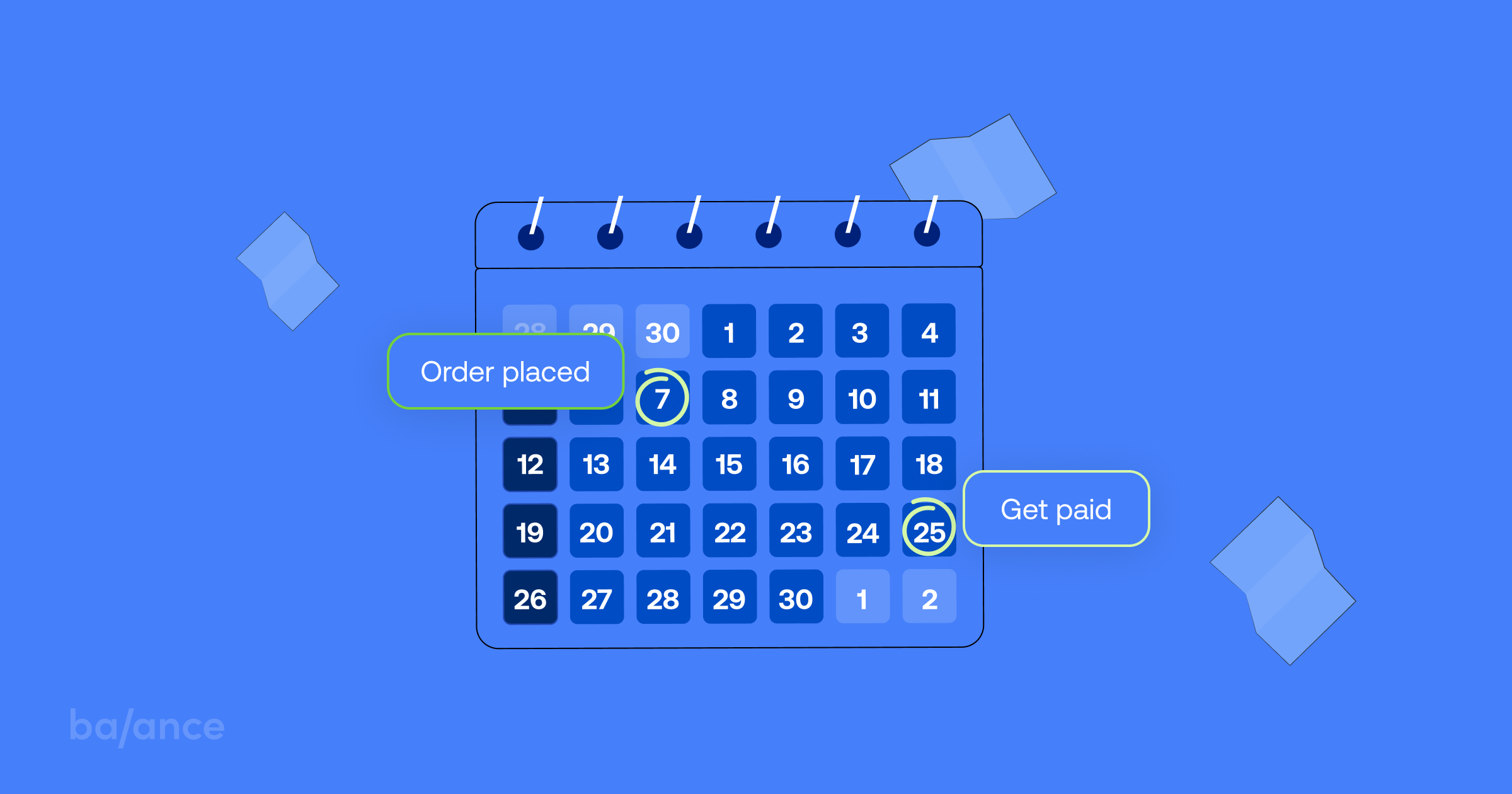

- Extend instant trade credit with up to net 90 days

- AI credit risk management, top approval rates

- E2E automation from qualification to reconciliation

- Customizable white label user experience

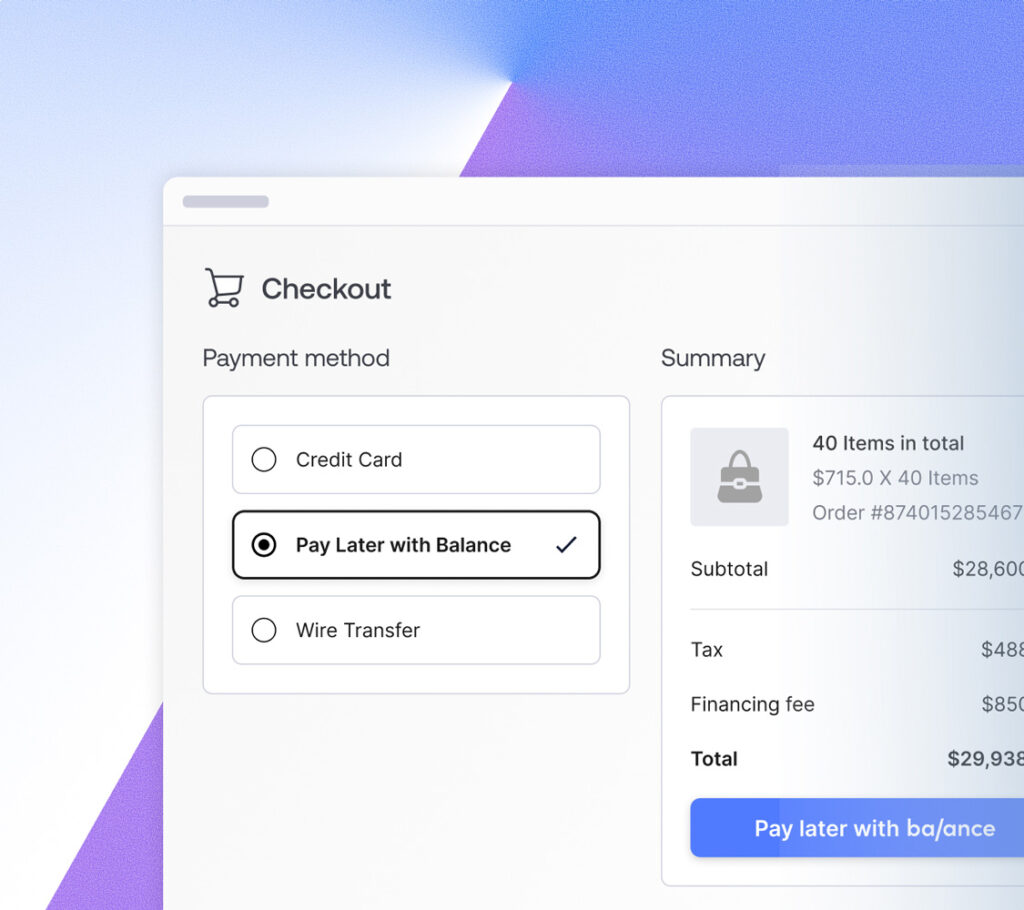

Embedded B2B financing

- Instant financing at checkout with up to 90 days to pay*

- High approval rates and credit limits for SMBs and enterprises

- Seamless, B2C-like buyer journey

- Balance-branded

B2B-optimized

payments stack

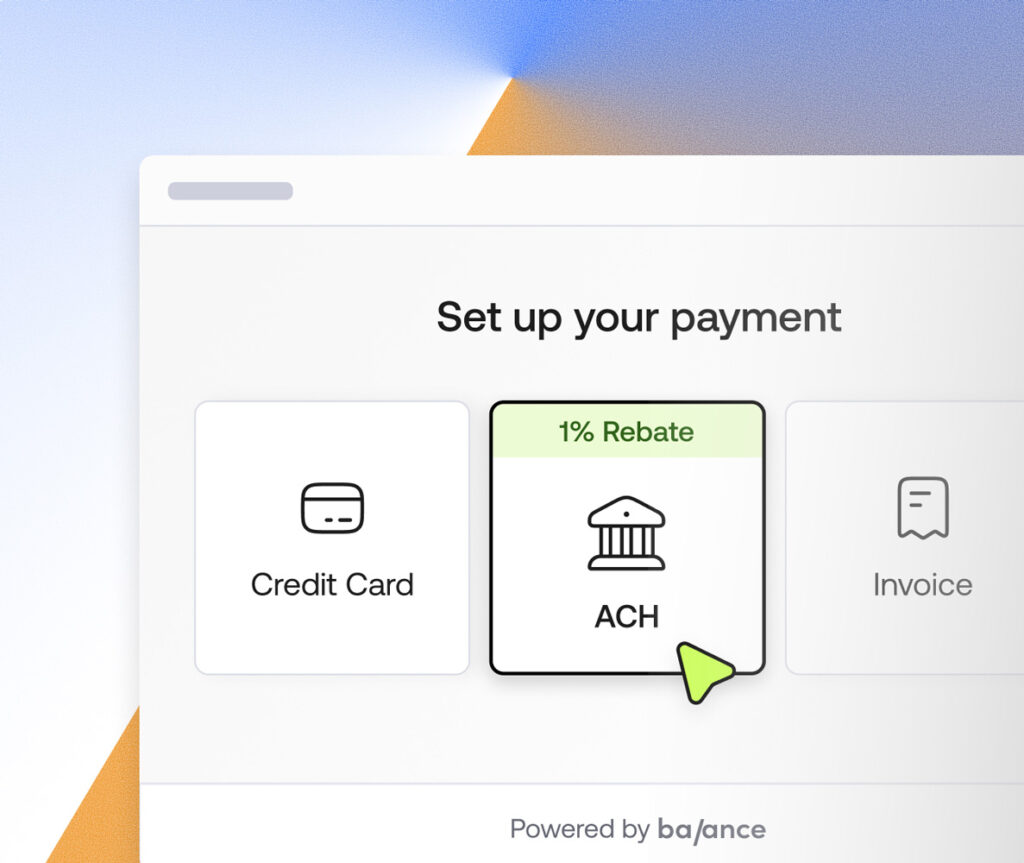

- Accept same-day ACH, wire, credit cards, and global payments

- Maximize savings with optimized IC+ using all relevant L2/L3 data

- Enable surcharges and personalized incentives at checkout

- Accelerate reconciliation with smart, accurate cash application

B2B Marketplace Payments, Solved

- Seamless buyer payments and instant vendor payouts

- Boost sales with embedded trade credit

- Simplify multi-vendor transactions with automated payouts

- Secure vendor and buyer transactions with built-in compliance

Why B2B Leaders Choose Balance

“For us, the results really speak for themselves — it’s retention of our existing customers, but it’s also new customer growth that we’ve been able to really quickly see and get signal on in such a short period of time.”

“By embedding Balance directly into our checkout, we’re making it easy for customers to buy on their terms, without being limited by cash flow constraints.”

“Our Dynamic Net Terms, powered by Balance, is not just a payment solution; it’s a catalyst for growth, designed to empower retailers who have historically been underserved.”

“The payment piece for us was critical. Balance solved that with their suite of products and robust APIs, which immediately stood apart from the traditional legacy solutions in the market.”

“We were able to grow our digital channel in ways we didn’t know were possible. Balance’s true uniqueness is in its product flexibility and ability to work with our existing business processes.”

Innovation That Gets Noticed

Integrate seamlessly

Leverage our robust APIs or pre-built native integrations to plug Balance

into your software stack, ERP, and B2B ecommerce platforms.

Leverage our robust APIs or pre-built native integrations to plug Balance into your software stack, ERP amd B2B Ecommerce platforms.

Make B2B Growth a Reality

Get expert advice on scaling payments and simplifying

operations. Book your consultation now.